ARK Invest Sells $146M in Circle Shares Amid CRCL Stock Surge

ARK Invest Sells $146M in Circle Shares Amid CRCL Stock Surge

ARK Invest Sells $146M in Circle Shares Amid CRCL Stock Surge

Cathie Wood’s ARK Invest has continued to sell off large portions of its Circle (CRCL) stock as prices surged dramatically following the company’s public debut.

On Friday, ARK sold 609,175 CRCL shares from three of its funds, totaling $146.2 million, according to a trade alert reviewed by Cointelegraph.

This sale came as Circle’s stock price jumped 20.4% in one day, closing at $240.30—a 248% increase from its initial price of $69 on the New York Stock Exchange on June 5.

Friday’s dump was ARK’s third major CRCL sale in a single week, bringing the total to 1.25 million shares sold, worth about $243 million based on closing prices.

ARK Offloading Around 300,000 Circle Shares Per Day

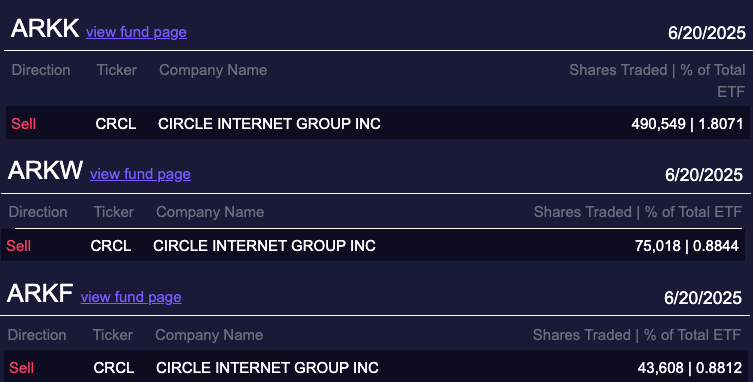

The shares were sold across three of ARK’s ETFs:

- ARK Innovation ETF (ARKK) sold 490,549 shares

- ARK Next Generation Internet ETF (ARKW) sold 75,018 shares

- ARK Fintech Innovation ETF (ARKF) sold 43,608 shares

Earlier in the week, ARK sold $52 million worth of CRCL stock on Monday, followed by another $45 million on Tuesday.

Still a Major Shareholder in Circle

Despite the sell-offs, ARK remains a major shareholder, ranking eighth among all CRCL investors as of June 20, 3:00 p.m. UTC, according to Bloomberg Terminal data.

ARK’s total divestment equals 29% of its original 4.49 million shares purchased during Circle’s public debut.

Here are the top three Circle shareholders:

- IDG-Accel China Capital Fund II – 23.3 million shares

- General Catalyst Group Management – 20.1 million shares

- James Breyer – 16.7 million shares

As of June 20, ARK still holds $750.4 million worth of Circle shares, with CRCL now becoming the top holding in the ARKW fund, making up 7.8% of its portfolio.