Nakamoto Holdings Raises $51.5M to Expand Bitcoin Treasury Strategy

Nakamoto Holdings Raises $51.5M to Expand Bitcoin Treasury Strategy

Nakamoto Holdings Raises $51.5M to Grow Bitcoin Treasury

Nakamoto Holdings, a Bitcoin-focused firm led by Trump’s crypto adviser David Bailey, has raised $51.5 million through a private investment in public equity (PIPE) deal. The funding will support the company’s Bitcoin accumulation strategy.

The announcement came via KindlyMD, which is set to merge with Nakamoto. Bailey said the money was raised in less than 72 hours, showing strong investor interest.

“Investor demand for Nakamoto is incredibly strong,” Bailey said. “We continue to raise capital to acquire as much Bitcoin as possible.”

The funding round was priced at $5.00 per share, bringing KindlyMD’s total funding to $563 million. Including convertible notes, that figure rises to $763 million.

Bitcoin Treasury as Core Strategy

Nakamoto Holdings launched earlier this year with a clear mission — to build a large Bitcoin treasury. Its strategy follows the example set by companies like MicroStrategy and Semler Scientific.

Most of the new funds will go toward buying Bitcoin. A portion will also support working capital and general business needs.

The financing is expected to close alongside the KindlyMD merger, scheduled for Q3 2025. KindlyMD trades on Nasdaq under the ticker NAKA. Shareholders approved the merger last month. Both companies plan to file the necessary documents with the SEC.

After the merger, the new entity will use debt, equity, and other financial tools to launch Bitcoin-native businesses. It also plans to continue increasing its Bitcoin holdings.

Bitcoin Treasuries Rise — Along With Risks

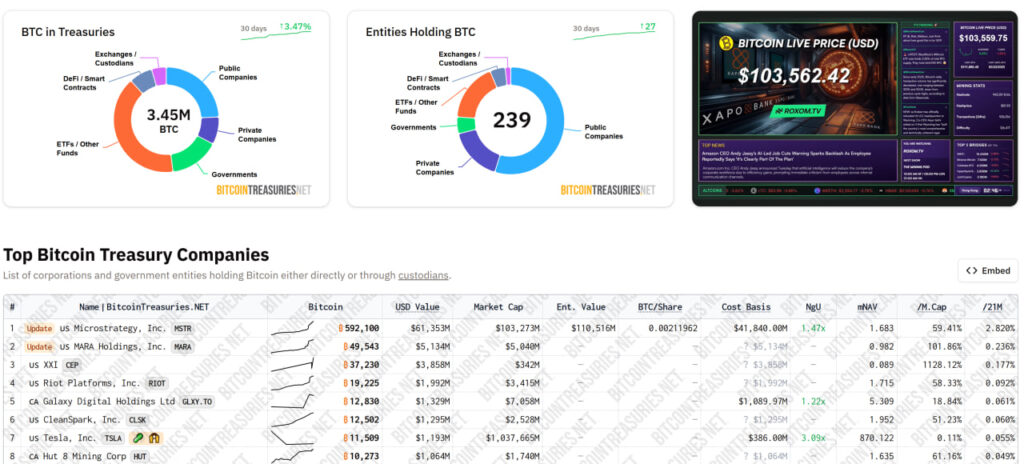

Public companies are increasingly adding Bitcoin to their balance sheets. At least 27 firms have done so in the past month, according to BitcoinTreasuries.NET.

But the trend has drawn some skepticism. Fakhul Miah of GoMining Institutional said smaller companies might be adding Bitcoin out of necessity, not strategy. He warned that some may lack proper risk controls.

Standard Chartered also issued a warning. If Bitcoin falls below $90,000, nearly half of these firms could face liquidation risks, the bank said. This could damage reputations and hurt broader crypto adoption.