BaFin Ends Ethena GmbH Probe With 42-Day USDe Redemption Plan

BaFin Ends Ethena GmbH Probe With 42-Day USDe Redemption Plan

German Regulator Closes Case Against Ethena GmbH Over USDe Issuance

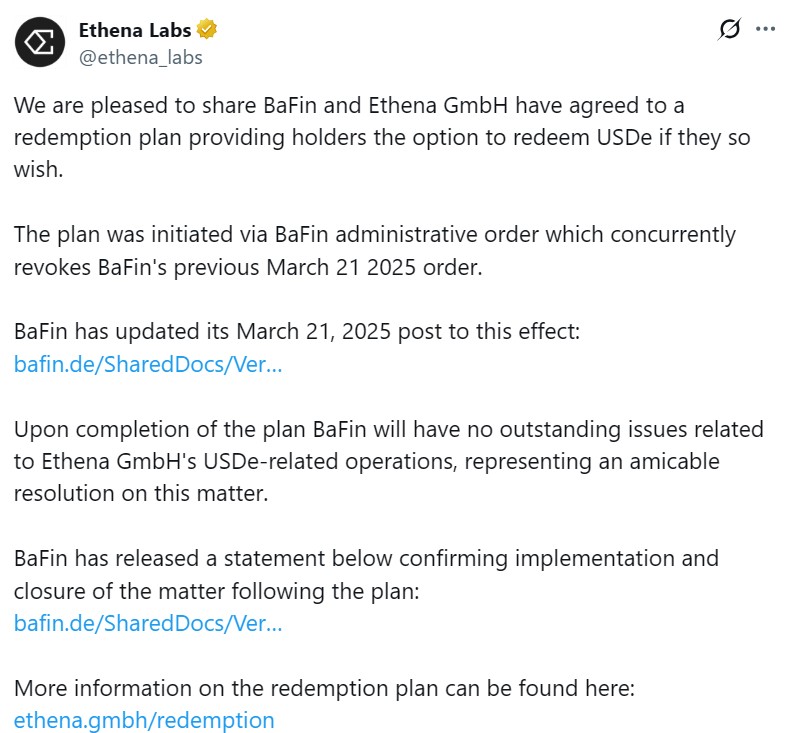

BaFin Ends Ethena, Germany’s financial watchdog BaFin has ended its months-long dispute with Ethena GmbH, the local arm of Ethena Labs, by finalizing a 42-day redemption plan for USDe stablecoin holders.

Ethena Labs confirmed the agreement on Wednesday, saying that BaFin initiated the redemption process, allowing users to file claims until Aug. 6. The process will be supervised by a BaFin-appointed special representative.

After the deadline, Ethena GmbH will cease operations in Germany, the European Union (EU), and the European Economic Area (EEA). From Aug. 7 onward, users must submit any remaining claims through Ethena’s offshore entity, Ethena (BVI) Ltd.

Ethena Labs stated that the redemption plan will resolve all regulatory issues related to Ethena GmbH’s USDe activity. However, the firm did not reveal whether it plans to re-enter the EU or EEA markets in the future BaFin Ends Ethena.

BaFin Concludes Four-Month Conflict With Ethena GmbH

The closure follows a four-month enforcement campaign by BaFin, which began on March 21 when it banned Ethena GmbH from offering the USDe stablecoin. The regulator cited violations of the Markets in Crypto-Assets Regulation (MiCA) framework.

BaFin alleged that the firm distributed unregistered securities through its yield-bearing sUSDe tokens, prompting immediate sanctions. These included freezing USDe reserves, shutting down the company’s website, and halting services for new users.

On April 15, Ethena Labs confirmed it had shut down all German operations and would not seek MiCA authorization. The firm emphasized that no USDe minting or redemption had occurred within Germany after March 21.

Ethena GmbH had applied for MiCA approval on July 29, 2024, but BaFin rejected the application, citing multiple compliance failures.

Despite the regulatory crackdown, over 5.6 billion USDe tokens remain in circulation globally—most issued before the MiCA framework took effect.